Annual net income formula

Net Income After Taxes - NIAT. The step-by-step process of calculating net income is as follows.

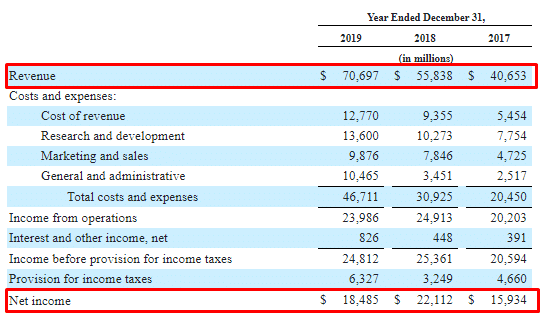

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Final Thoughts You can include other incomes besides your gross income as weve mentioned above.

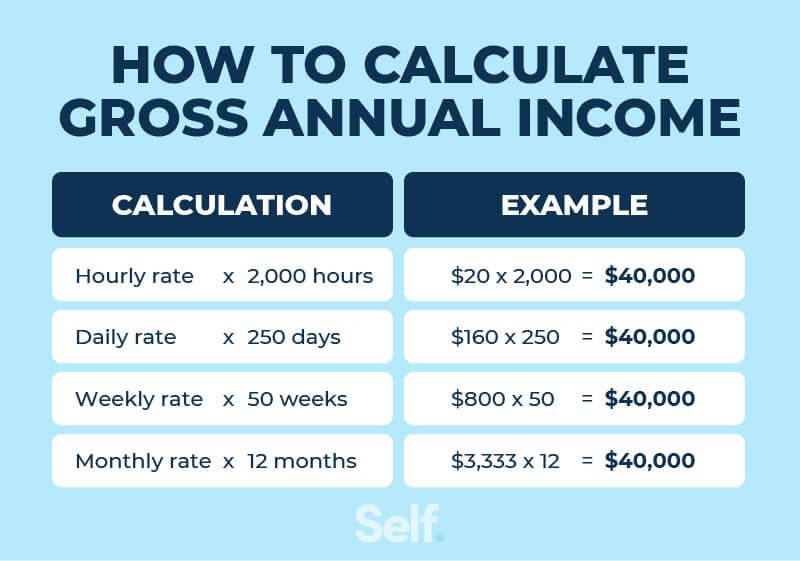

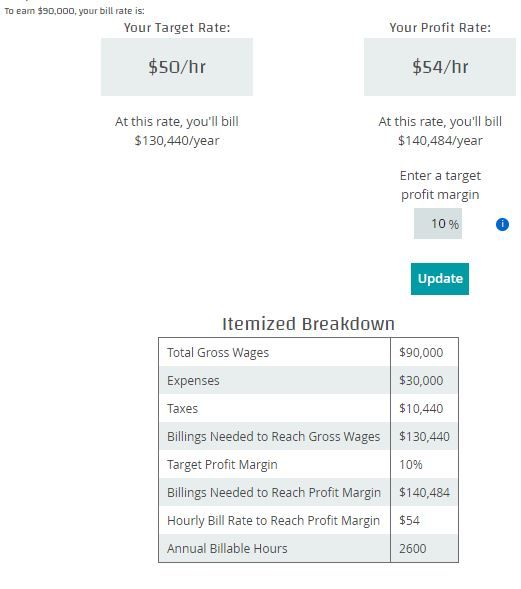

. Total Work Hours in a Year. Add any extra payments you receive like part-time job wages. Below is how to calculate the amount of annual net income you make based on your gross income.

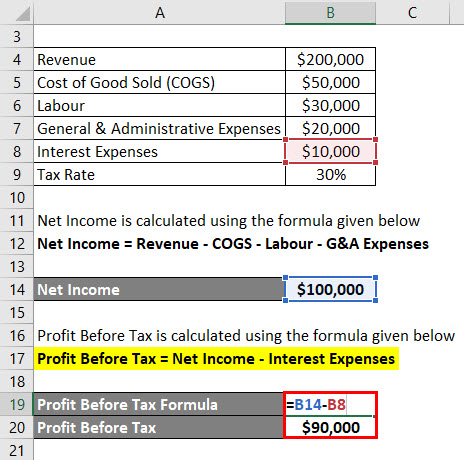

Net Operating Income - NOI. Therefore DFG Ltd generated net operating income of 70000 during the year. Net Operating Income 70000.

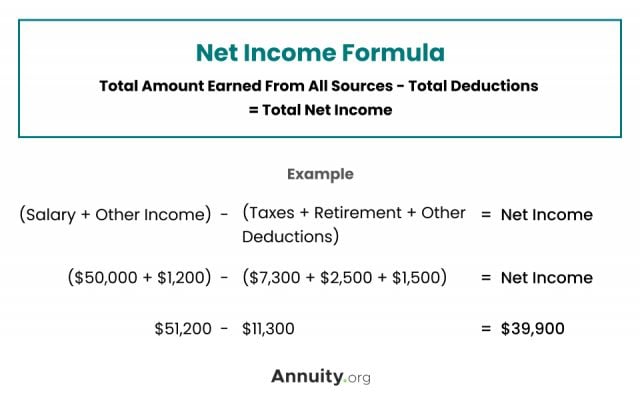

Net income refers to income after taxes so you will need to subtract deductions from your gross annual income. Net Operating Income 500000 350000 80000. The annual income calculation assumes that there are 52 working weeks in.

41990 6776 48766 this is Mollys annual net income. Knowing your annual net income can help you best understand what additional expenses you can handle. The formula for the annual income is.

Of Years 1 Annual Return 210 100 1 5 1 Annual Return 160. Now you can plug both numbers into the net income formula. To show an example someone with a gross annual income of 200000 and a tax rate of 15 and a CPF deduction of 25 has a net annual income of 120000.

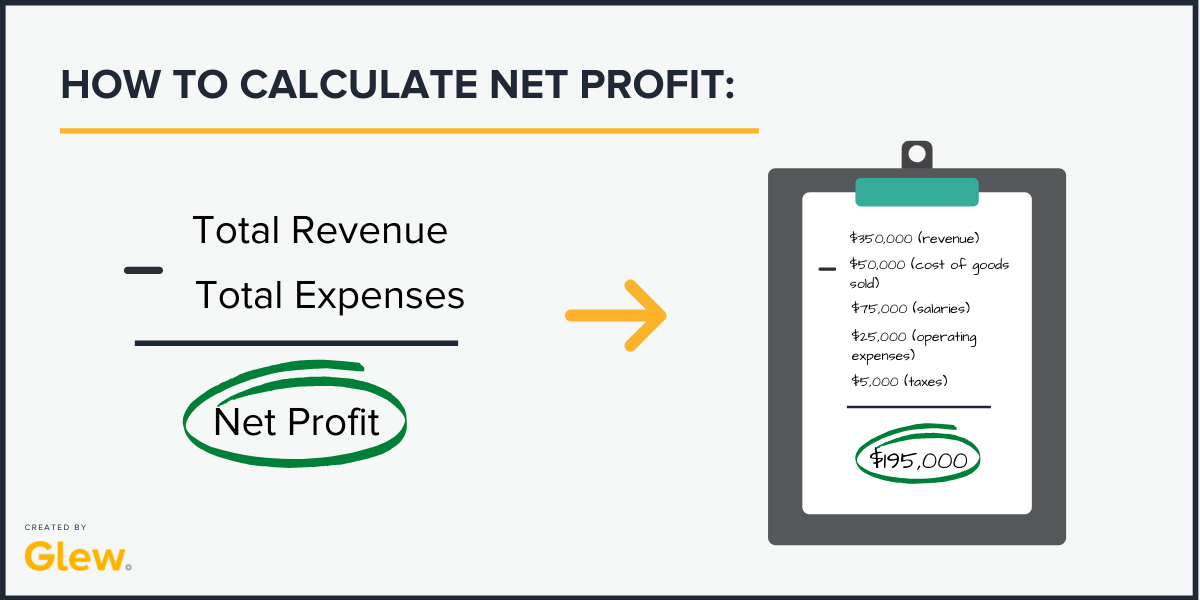

After determining the total revenue and expenses you can calculate net income by using the following formula. This formula assumes you work an average of 40 hours per week and 50. Hes paid on a bi.

Add your additional income to your gross. This excludes your paid time off. Net income total revenue 75000 total expenses 43000 Net income 32000 In the first quarter your.

Net income 40000 - 20000 20000 Wyatts net income for the quarter is 20000 How Bench can help Net income is one of the most important line items on an income. Your annual income after taxes. Estimated number of hours worked per week x hourly rate x 52 gross annual income The 52 represents the number of weeks you work throughout the year.

Use the net income formula. Annual net income Gross income Expenses Additional income Annual net income example calculation John has an annual salary of 10000 per year. Net income Total revenue.

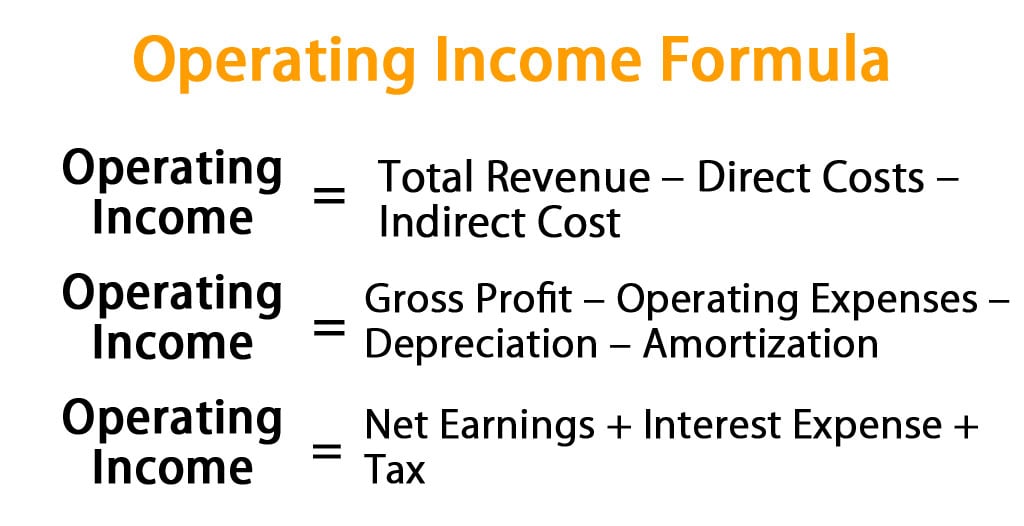

Convert your hourly daily weekly or monthly wages with the formula below to get your annual income. Revenue Cost of Goods Sold COGS Gross Profit Gross Profit Operating Expenses OpEx Operating Income EBIT. Once you remove the deductions you will be left with your.

Net operating income equals all revenue. Annual income hourly wage hours per week weeks per year If you want to do it without the yearly salary income calculator. Net income after taxes NIAT is an accounting term most often found in a companys annual report that is meant to show the companys.

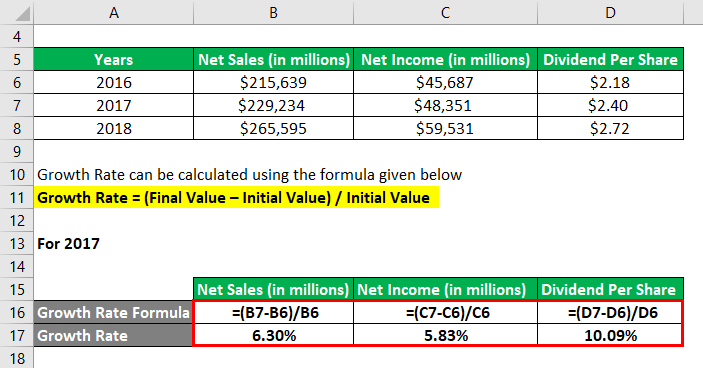

Annual Return is calculated using the formula given below Annual Return Ending Value Initial Value 1 No. Net operating income NOI is a calculation used to analyze real estate investments that generate income. Determine your annual salary.

How To Find Net Income For Beginners Pareto Labs

What Is Annual Income And How To Calculate It Self Credit Builder

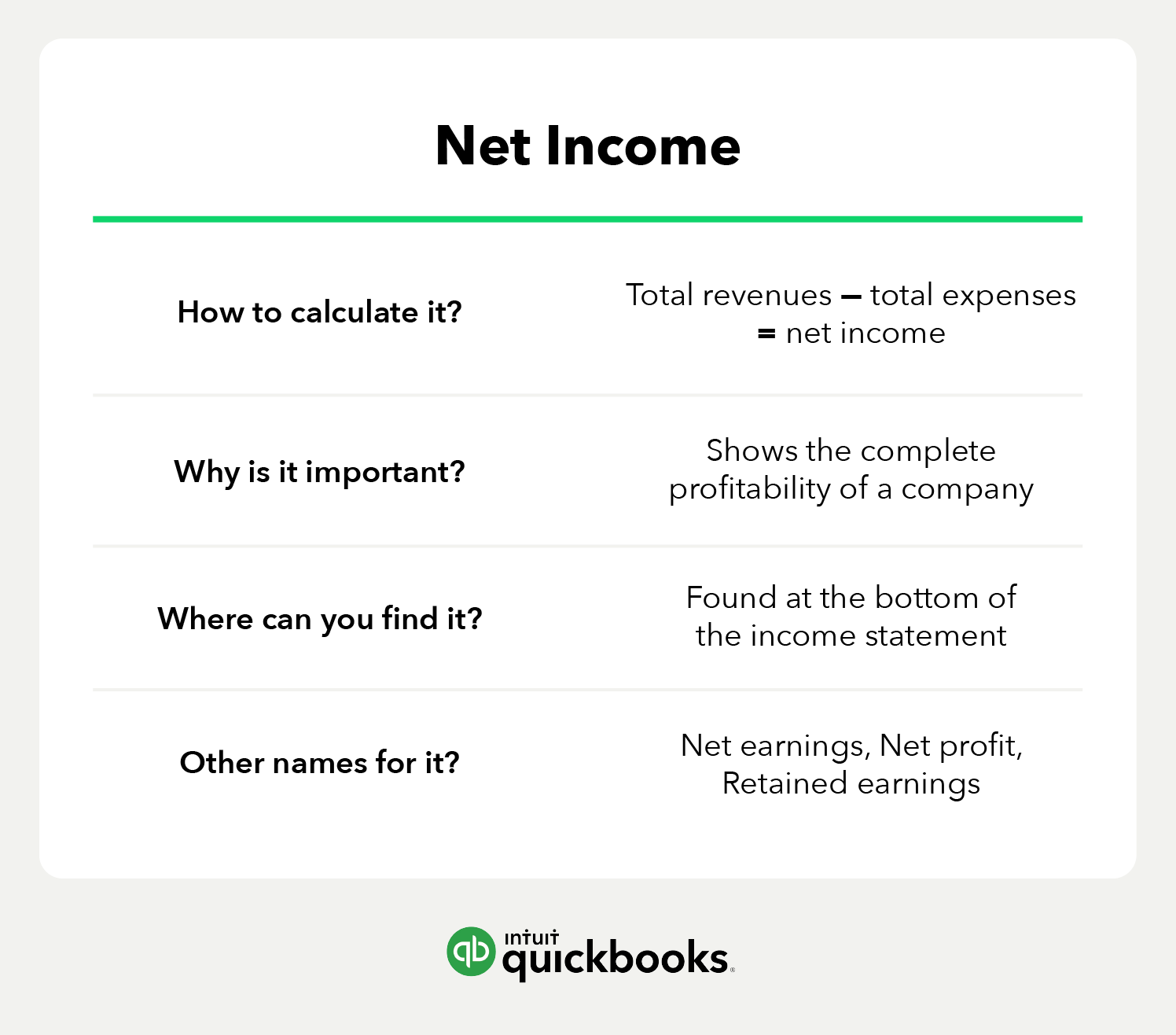

Net Income What Is It How Is It Measured

How Do You Use The Roi Formula On Excel Monday Com Blog

What Is Net Income Retipster Com

Taxable Income Formula Calculator Examples With Excel Template

What Is Net Profit And How To Calculate It Glew

Net Income Ni Definition Calculation Formula Finance Strategists

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

Net Income Formula And Calculation Example

Operating Income Formula Calculator Excel Template

Nopat Formula How To Calculate Nopat Excel Template

How To Calculate Net Income Formula And Examples Bench Accounting

Growth Rate Formula Calculator Examples With Excel Template

What Is Net Income Definition Formula And How To Calculate Stock Analysis

What Is Net Income Formula Calculations And Examples Article

How To Find Net Income Calculations For Business